Second Quarter Compliance Updates (Benefit Minute)

Posted in: Benefit Minute, Employee Benefits

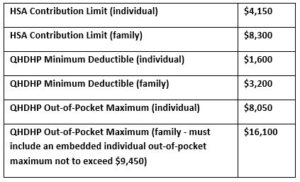

HSA Limits for 2024

IRS Revenue Procedure 2023-23 updated the limits for qualified high deductible health plans (QHDHPs) for plan years beginning in 2024 as well as the 2024 calendar year health savings account (HSA) contribution limits, as set forth below:

For non-grandfathered health plans that are not QHDHPs, the out-of-pocket maximums for plan years beginning in 2024 are $9,450 (individual) and $18,900 (family – must include an embedded individual out-of-pocket maximum not to exceed $9,450).

Expenses Related to Covid-19 and Preventive Care for Purposes of QHDHPs

Generally, a qualified high deductible health plan (QHDHP) is not permitted to provide any benefits (except preventive care services) until the plan deductible is met. During the Covid-19 public health emergency, the IRS provided relief that allowed (but did not require) a QHDHP to provides benefits for medical care services and items purchased related to testing and treatment of COVID-19 prior to the satisfaction of the deductible without jeopardizing eligibility to contribute to a health savings account. For any QHDHP that relied on this relief to provide pre-deductible coverage for Covid-19 testing and treatment, the IRS has issued guidance in Notice 2023-37 that it will no longer be available for plan years ending after December 31, 2024 (i.e. relief would be available for a plan year beginning January 1, 2024, but not February 1, 2024).

Once this relief is no longer available, Covid-19 testing and treatment will be subject to the QHDHP deductible. However, the guidance clarifies that if Covid-19 testing were to be recommended with an “A” or “B” rating by the US Preventive Services Task Force (USPSTF) in the future, then that testing would be treated as preventive care services. Covid-19 vaccines are currently classified as an ACA preventive care service that must be covered in-network without cost sharing by all non-grandfathered group health plans.

FSA Substantiation Reminder

The IRS Office of Chief Counsel recently issued a memorandum as to whether different potential methods of flexible spending account (FSA) claims substantiation are compliant. While this memorandum does not break any new ground, it serves as a reminder regarding substantiation requirements. Under the Code section 125 cafeteria plan rules, every FSA claim must be substantiated with a document that includes date of service, description of expenses and the expense amount, along with either proof of payment or a statement from the participant that the expense has not and will not be reimbursed from another source. For debit card transactions, substantiation may be in the form of inventory information approval system, co-pay or recurring expense logic, or documentation submitted to the FSA administrator after the point-of-sale. The IRS memorandum states that the following methods of substantiation are not acceptable:

- Self-certification – since no third party documentation is submitted

- Sampling of expenses paid on a debit card – since this technique does not ensure that every claim is substantiated

- De minimis exception – since this is another technique that does not ensure every claim is substantiated, regardless of amount

- Favored provider expense exception (for certain dentists, doctors, hospitals or other health care providers) for debit card transactions – since there is no third party documentation

- Advanced substantiation for dependent care expenses – since reimbursement of claims cannot occur until the dependent care services have been provided

When FSA expenses are not properly substantiated, amounts reimbursed should be included in the participant’s taxable income. In addition, non-compliance with the substantiation requirements results in the failure to operate in accordance with section 125 and could jeopardize the tax-favored status of the plan as a whole. Plan sponsors should ensure that their FSA administrator complies with these substantiation requirements (both contractually and in practice) and should not allow exceptions that result in reimbursement of any FSA expenses without appropriate substantiation.

IRS Rejects Another “Double Dip” Arrangement

The IRS Office of Chief Counsel recently issued a memorandum that discusses the tax treatment of wellness benefits provided under a fixed-indemnity insurance policy. Under the arrangement, employees may enroll in voluntary coverage under a fixed-indemnity health insurance policy for a monthly premium of $1,200 that is paid by salary reduction through a Section 125 cafeteria plan. The fixed-indemnity health insurance policy provides a benefit for each day that the employee is hospitalized. In addition, the fixed indemnity policy also pays a $1,000 monthly wellness benefit to employees who undertake certain health or wellness activities, including obtaining preventive care services (that are generally provided at no cost offered under a group health plan) or participating in health activities such as wellness counseling, nutrition counseling or telehealth that are provided at no additional cost to the participant. Under the fixed-indemnity health insurance policy, the wellness benefits are paid from the insurance company to the employer, which then pays them out to employees.

Promoters of this arrangement claim that the $1,000 per month reimbursement is a medical benefit that can be paid by the employer on a tax-free basis. The IRS disagreed, concluding that payment must be included in the employee’s gross income and treated as wages for employment tax purposes because the fixed-indemnity health insurance policy pays the monthly wellness benefit without regard to whether the employee has incurred any unreimbursed health insurance expenses.

This is the latest iteration of double dip arrangements that proports to provide tax-free health benefits, when in fact they are impermissible attempts to avoid income and employment taxes.

Download a Copy of this Benefit Minute

Evolving healthcare legislation requires continuous benefits plan compliance oversight, which may be overwhelming for your organization. Take a deep breath—our compliance experts can help! Learn more about Employee Benefits Compliance services to protect your organization from fees and penalties.